Productivity in the Chilean Mining Industry

One of my favorite reports that does a great job of outlining where the Chilean mining industry stands in term of competitiveness was published in 2018. “Productivity in the Chilean Mining Industry” provides some great insights into where Chile is lagging in comparison to other countries. As a result, the report can give suppliers an idea of the opportunities that exist in the Chilean mining market since improvements to productivity have a significant impact on the profitability of any given operation.

As background, productivity in the Chilean mining industry has lagged that of other developed mining jurisdictions for some time. In response to these concerns, the government conducted a study in 2018 through Comisión Nacional de Productividad (CNP).

The study consisted of the following:

- Collaborative report between CNP, Mining Ministry, Cochilco, Mining Council, Fundación Chile, Matrix Consulting and many others.

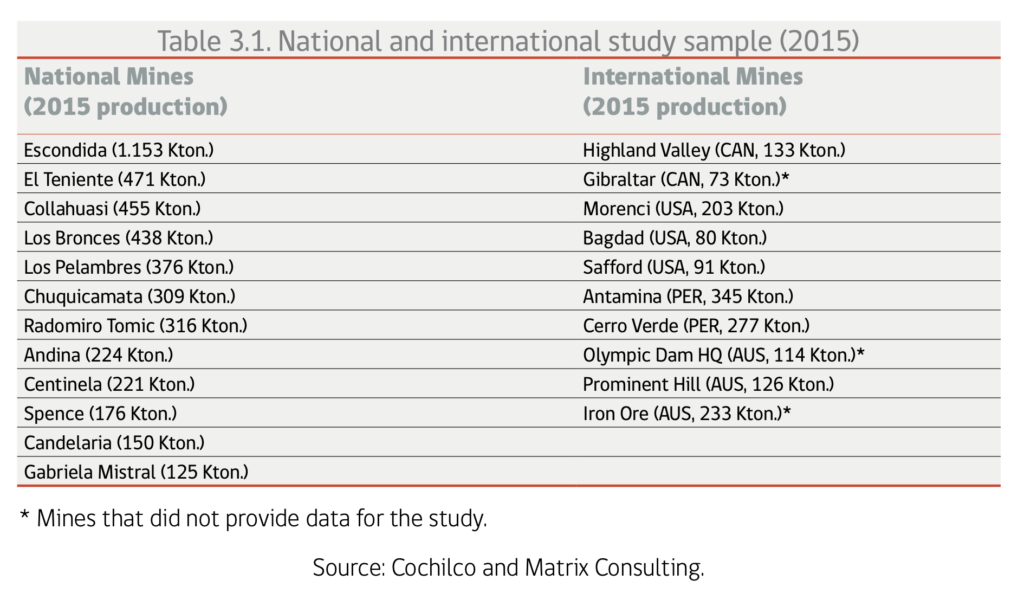

- Benchmark analysis comparing 12 Chilean large scale copper mining operations with best practice operations from Australia, Canada, United States, Peru and Sweden (sample is 30% of world production)

- Over 500 interviews from 12 Chilean mines, 7 international best practice mines (1 Australian), suppliers, contractors, institutions, and experts.

Chilean Competitiveness

The reports main findings found that the fall in productivity was mainly due to the companies’ reaction to the super cycle of copper prices, which led them to prioritize the level of production over other criteria such as efficiency.

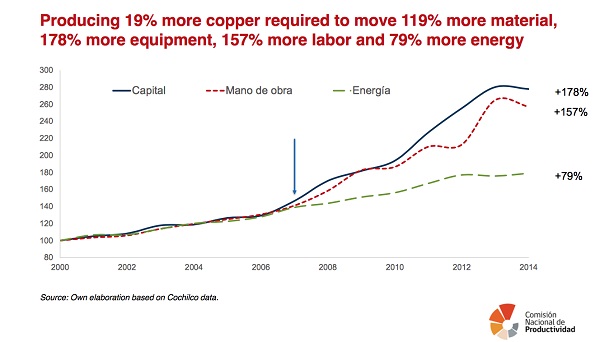

To provide some context, copper production in Chile rose 19% between 2000 and 2014. However, this required 79% more energy, 157% more labor, and 178% more capital. The result is that there was a substantial increase in the amounts of inputs while only a modest increase in production which resulted in poor productivity. With that being said, the required inputs also increased due to a number of factors such as significantly deteriorating ore grade, which meant that mines had to load and process an additional 40% to achieve the same amount of fine copper.

Since the report was published and the periods that were studied, mining operations have focused on increasing productivity but as we head into another period of high pricing, this is a good reminder that operations will need to stay focused.

Bench Marketing – Chile vs International Operations

In the year 2000, the least productive operations in Chile required 82 working hours to move a kiloton of material, but 162 working hours in 2014.

The median-productivity mining companies went from 26 (2000) to 63 (2014) working hours per kiloton moved; while the high-productivity group went from 19 (2000) to 22 (2014) working hours per kiloton moved.

The sample includes twelve Chilean mining operations with annual production over 100,000 tons each. This sample accounts for approximately 75% of Chile’s copper production. The sample of international operations accounts for 35% of the world’s total copper production and 50% of global copper production of mines that produce over 100,000 ton.

Labor Productivity

In terms of labor productivity, the report states that during 2015 the most efficient operation in the Chilean sample required an average of 43 person-hours to move a thousand tons of material, while the less effective required 115 person-hours for the same job. The national average was 67 person-hours per thousand tons of material. The differences between Chilean mines would be attributable to the mines’ particular factors, especially personnel and asset management, as well as the mining plan.

The average of the international sample (30) is slightly less than half the national average (67). That is to say, in 2015 the domestic mines required more than twice the amount of person-hours per thousand tons of material moved than the international average. Also, it is worth mentioning that the local best-performing operation shows 44% more person-hours than the average world sample and 139% more than the best international mine. This productivity gap may be capturing differences associated with institutional, normative, or gaps in labor skills.

Capital Productivity – Equipment Utilization

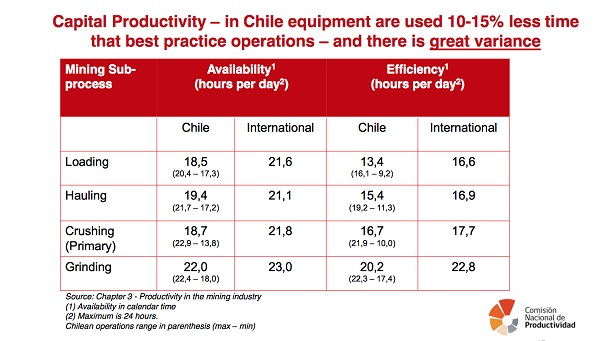

The report simplifies its analysis by showing equipment availability in a 24-hour span. On average, in Chile, the trucks are available 19.4 hours versus 21.1 hours of the international sample. In Chile, of these 19.4 hours, the asset ends up being effectively used 15.4 hours, while the international sample, on average, uses 16.9 hours (out of the 21.1 hours available). That is, the international sample uses an additional 10% of the truck per day that the national mines.

Conclusion

The report concludes that in terms of labour and capital productivity, there is room for improvement. The first is to raise the productivity of the worst Chilean mines to the same level as the best rated mines in the country, which must be done by the companies themselves. The second is to bring the national average closer to the international average which requires both public and regulatory policy improvements.

The majority of short-term productivity gains will depend on factors manageable by the mining companies themselves. However, an important part will be based on better public and regulatory policies that support productivity. Lastly, the mining companies’ relations with their suppliers and contractors will also be an important factor.

Next week we will provide an overview of the specific recommendations that came from the report.

Ax Legal is a legal and business advisory firm that works with foreign companies in Latin America. Our team of legal and commercial advisors have a distinguished track record of helping foreign technology and services companies to grow and operate in Latin America. Over the years, we have worked with starts up, mid-size businesses, and publicly listed companies. The one common factor that connects are clients is that they are leaders in their field, providing innovative technologies and services to the industrial sectors.

To better understand how we can support you in the Region, please contact Cody Mcfarlane at cmm@ax.legal

Santiago

Santiago Sydney

Sydney Lima

Lima