Argentina Lithium Project Pipeline

Argentina, Chile, and Bolivia make up the lithium triangle which are thought to contain roughly half the world’s known lithium. According to the US Geological Survey, Argentina has an estimated 19.3Mt of the world’s 89Mt lithium resources. Bolivia (21Mt), Chile (9.8Mt), and Australia (7.3Mt) round out the top four countries in terms of estimated resources.

In terms of actual output, Bolivian production has been non-existent. Chile was a global top producer until a few years ago when it was surpassed by Australia. The Chilean industry has been held back due to lithium being classified as a strategic mineral which requires special permissions from the government. Although Chile has been producing lithium for some time, it has been unable to capitalise on its experience and attract the needed investment to grow production.

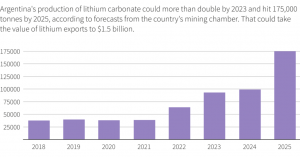

The slow growth of the Chilean lithium industry has provided an opportunity for its neighbour, Argentina, who has taken a more liberal approach to developing the industry. The result has been an influx of foreign investment that is set to pay off over the next few years. In 2020, Argentina produced 33,000t of lithium carbonate which will increase 50,000t this year. There are estimates that Argentina could double production in 2023 and hit 175,000t in 2025.

Argentina has a healthy lithium project pipeline. There are already two projects in production with plans for expansions. This year, construction has started on several more projects and there are even more projects that are being explored.

Operating Projects

|

Fenix |

|

|

Olaroz |

|

Projects in Construction |

|

|---|---|

|

Cauchari-Olaroz Project |

|

|

Centenario-Ratones Project |

|

|

Sal de Oro |

|

|

Sal de Vida |

|

Challenges

Argentina faces the same environmental concerns as Chile in terms of expanding lithium production. Communities are worried about disrupting fragile ecosystems by taking water from critical areas. Many companies are focusing on DLE to reduce water usage, but the technology has not been deployed at scale yet.

Other challenges include lack of infrastructure and power where these mines are being built. Many of the lithium projects are in areas to the far north of the country where there has been a lack of government funding over the years.

Lastly, the foreign currency restrictions currently in place also represent a challenge to the sector’s expansion since there are limitations on companies taking profits overseas. For miners this may not be an immediate concern as they seem to be happy to reinvest profits back into expansions but for technology and service suppliers this can create issues. Payment of their services and products are delayed and they are often pressured to have local entities with no means to repatriate funds.

Added Value

Argentine has inaugurated a US$2.5 million lithium-ion batteries and cells plant in La Plata. The facility is expected to go into production in December, targeting 300 cells of 64Wh per day.

Investment was provided by the ministry of science, technology, and innovation (Mincyt) and the energy and research company YPF-Tecnología. The plant required 200mn Argentine pesos (US$1.5mn) for infrastructure and US$2.5mn for the equipment.

Some criticisms of the project are that the battery cost could be higher given that some components need to be imported.

Conclusion

Argentina has taken a different approach to developing its lithium industry. This has positioned the country as a leading investment destination for lithium production. The lithium pipeline is advancing. New projects will catapult the country into one of the largest global producers putting Chile position as the number 2 producer at risk.

Argentina has been able to make a small investment into battery production which will be beneficial as the country looks to build a value-added industry around its lithium resources. Something that Chile has tried but has been unable to do yet. That investment and know how from the small pilot could potentially trigger further investment in the coming years.

The bigger story is that Argentina has been able to attract more investment than Chile. While Chile has created uncertainty around its industry with complex rules, Argentina has made it relatively easy for companies to explore and develop projects.

There are still challenges for Argentina to overcome. Structural debt issues, ever changing taxation policies, and capitial controls are the most immediate challanges. As more projects come online, there will be more focus on the environmental impact it may have on fragile ecosystems. DLE technology is certainly important but how effective it will be is still in question. Over the next couple years, these questions should be answered and hopefully Chile is not left in the dust.

Ax Legal is an advisory firm that works with foreign companies in Latin America. Our team of legal and commercial advisors have a distinguished track record of helping foreign technology and services companies to grow and operate in Latin America. Over the years, we have worked with starts up, mid-size businesses, and publicly listed companies. The one common factor that connects our clients is that they are leaders in their field, providing innovative technologies and services to the industrial sectors.

To better understand how we can support you in the Region, please contact Cody Mcfarlane at cmm@ax.legal

Santiago

Santiago Sydney

Sydney Lima

Lima