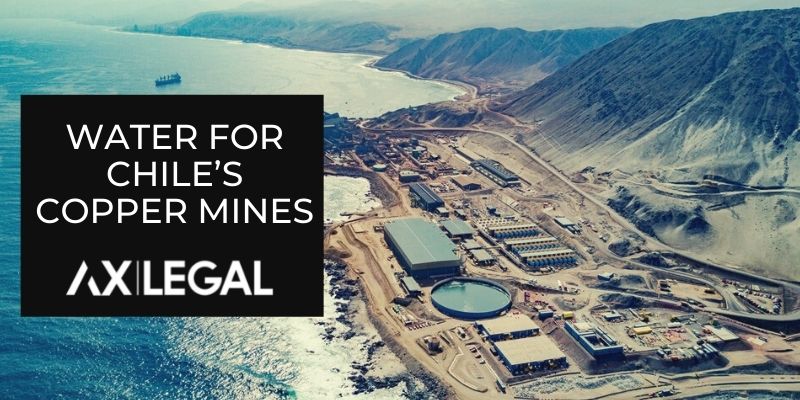

Chile has faced a severe and long drought. Although the mining industry only uses 9% of the countries water, most operations are located in Northern Chile where water is the scarcest. Mining companies are going to extreme lengths to ensure they have water for thier operations.

Full storyCan Chile be a Leading Green Hydrogen Producer?

Can a small country with a population of 19 million located at the most southern tip of the world produce the cheapest green hydrogen on the planet and be among the top three exporters of the fuel two decades from now. Check out part one of our series outlining the steps that Chile is taking in order to compete on a global level.

Full storyFeature Interview – Autonomous Technology in Chile

Chile is rapidly moving to autonomous trucks in its mining operations. We speak with Alexis Méndez, a Chilean Mining Engineer, who has spent his career helping mining operations to evaluate, implement, and operate autonomous technology.

Full storyKinross’s USD$1b Lobo-Marte Project Advancing

Another project in Chile’s USD$68.9 billion project is advancing. This time it is Kinross’s usd$1b Lobo Marte which has completed its prefeasbility study and is now moving to its enviromental permits.

Full storyChile Project Pipeline Update – $68.9 billion in mining investments from 2021 to 2030

The Chilean state copper commission released its new forecast for the mining project pipeline which accounts for $68.9 billion in mining investments from 2021 to 2030.

Full storyPeru Mining Project Update

Peru has a large project pipeline of mining projects totaling approx. USD$58bn. There are 7 projects that are set to enter construction in 2022.

Full story

Santiago

Santiago Sydney

Sydney Lima

Lima